Can You Have a Dual Hong Kong and US Citizenship?

Despite the laws on dual citizenship in mainland China, some wealthy people in Hong Kong secretly hold foreign passports. However, the U.K. recently offered extended visas for British National (Overseas) passport holders, which include all Hongkongers born before the 1997 handover. Beijing responded by not recognizing these passports anymore. Here are the main steps involved in dual citizenship. The first step is to obtain the proper documentation.

Investing in the U.S.

Investing in the U.S. is the most popular method for foreign investors. Its securities market has a robust selection of investment products. The mutual fund universe offers thousands of pooled investments managed by professional experts. Even if your idea is too foreign for the U.S. market, you can still find ways to invest in the U.S., including investing in equities. You can also invest in cryptocurrencies.

The largest foreign direct investment flows to the U.S. are from Canada, Germany, Ireland, and Japan. The largest investment sectors are manufacturing, trade and maintenance, and financial activities. In 2011, Texas and California attracted nearly USD 18.6 billion in foreign direct investment. New Jersey attracted USD 14.1 billion in investment. The OECD estimates that FDI inflows to the U.S. will reach almost $1 trillion in the first semester of 2021.

Another benefit of investing in U.S. stocks is that they pay high interest in dollars. In addition to earning interest in dollars, U.S. stocks are typically well-known and trusted companies. Additionally, the U.S. economy is more significant than India’s, meaning the stocks listed here represent a huge market. US-listed companies account for between 35 and 40% of global market capitalization. Whether your interests lie in manufacturing, technology, finance, or any other sector, there is a market in the U.S.

Foreign investors may put their money in the United States because of strong economic ties. This can be measured by trade flows, inexpensive communication, and standard languages. These connections can help foreign investors make money in the U.S. and make them feel more comfortable in the U.S. market. A lot of foreign high-net-worth individuals are interested in investing in U.S. stocks. More than a quarter of non-Hispanic households own stock, compared with 31% of Hispanic households and only 28% of black families.

Despite the uncertainty and risk in the U.S. economy, investing in the stock market is essential to most people’s financial planning. The economy is struggling through an era of high inflation, and the coronavirus epidemic revealed how volatile it is. Most of these people have invested in retirement accounts or the market. This makes it essential to diversify your investments by mixing safe and risky assets.

You can invest directly in stocks by purchasing individual stocks. However, this requires a certain level of expertise. Inexperienced investors should avoid direct investing in stocks. For more experienced investors, you can opt for mutual or exchange-traded funds, which give you access to several U.S. stocks. You can also invest in ETFs that track specific sector. Choosing ETFs over individual stocks may be a better option because they require lower fees.

Shared rights and responsibilities

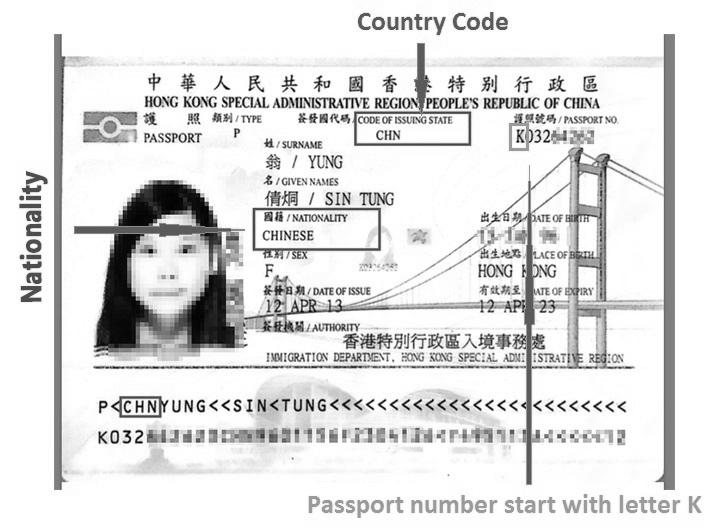

While the two countries are not technically equal, the two are governed by different systems and laws. Hong Kong is a Special Administrative Region of the People’s Republic of China, and the Chinese government manages its foreign relations. However, Hong Kong has its own customs territory and is a separate economic entity from China. As such, it has the right to enter international agreements separately in some areas of law.

In the 1990s, the U.S. and Hong Kong policy was amended to remove the differential treatment. While the U.S. government no longer provides foreign assistance to Hong Kong, it does maintain substantial economic ties with the territory. American companies increasingly view Hong Kong’s business environment cautiously, but they still value the location, low taxation, access to the Chinese market, skilled workforce, and infrastructure as an advantage. Today, there are about 85,000 American citizens living in Hong Kong.

In addition to these benefits, Hong Kong residents also enjoy the freedom of emigration under Article 31 of the Basic Law. The Bill of Rights also guarantees the freedom of movement for Hong Kong residents. Therefore, U.S. citizens can travel freely to and from the territory and vice versa. In addition to the benefits mentioned above, the rights and responsibilities of U.S. citizens are similar in Hong Kong. If you are considering dual citizenship, consider the benefits and drawbacks of each.

The Basic Law protects the labor force’s right to social security and retirement security. Hong Kong’s government provides social security through Comprehensive Social Security Assistance. There is also a mandatory retirement saving scheme known as the Mandatory Provident Fund, which requires contributions from both employees and employers. The bill is expected to be passed in both chambers of Congress and will remain in effect until 2027.

Although there are no official statistics, newspaper reports show a marked increase in protests in Hong Kong from 2000 to 2004. However, the number stayed around 200 cases until 2006. Then in 2003, the first July march halted the implementation of a national security bill and gave civil society a chance to show its strength. As a result, the government is now forced to enact laws protecting human rights.

The government must protect the national security of Hong Kong. Article 23 of the Basic Law sets out its constitutional duty to protect national security. The government introduced a bill to protect its citizens from subversion, but civil libertarians opposed it, fearing that the law would restrict the people’s fundamental rights. This new law is a significant threat to human rights defenders, critical media reporting, and civil society.

Investment path to dual citizenship

In a nutshell, the investment path to dual Hong Kong and U.S. citizenship is an excellent opportunity for those who want to work in their native country but have their heart set on obtaining a passport. However, there are many drawbacks. First, you’ll have to renounce your first citizenship. You’ll also need a U.S. passport. In addition, you’ll have to live in the U.S. for at least half the year. Ultimately, you’ll want to invest in a company to be eligible for a U.S. passport.

Investing in a company offering citizenship by investment is the fastest way to obtain dual Hong Kong and U.S. citizenship. There are also several ways to get this status. Some countries grant fast-track permanent resident status to foreigners married to a citizen. Another method is spousal sponsorship. This allows the foreign spouse to receive citizenship by investment within two years. Other countries offer residency by investment programs, whereby foreign nationals invest in the host country’s economy. Investment in a company will qualify you for permanent residence in the host country.

The cheapest way to earn dual citizenship is to invest in real estate. In some countries, you can support up to $200k in real estate and get citizenship in as little as 60 days. But this process is also one of the most complicated and time-consuming. And it’s not the fastest path to dual Hong Kong and U.S. citizenship. There are other ways to obtain dual citizenship, but most people opt to invest in property as this method offers the most significant benefits.

The quickest and easiest way to acquire dual Hong Kong and U.S. citizenship is to invest in property in the countries that offer this opportunity. Some countries will even offer citizenship in exchange for an investment — the most popular route to dual citizenship. This method is known as citizenship by investment and is available in 11 countries. You’ll be required to live in a country that offers citizenship by investment program. Once you’ve met these requirements, you can apply to the respective government.

If you’re a high-net-worth individual looking to emigrate, dual citizenship is an option that may be right for you. While dual citizenship benefits people who enjoy the conveniences of belonging to two different nations, it’s essential to understand the risks and benefits of this path. If you’re serious about dual citizenship, you’ll need to work with a qualified immigration lawyer who can help you navigate the complexities and pitfalls associated with dual citizenship.

The investment path to dual Hong Kong and U.S. citizenship involves a nonrefundable contribution of EUR610,000 and residence in the country for at least 12 months. While this is not a typical path to dual citizenship, the process does pay off. It pays off in the long run, with the property prices and rental income bonus. It is also a great way to become a U.S. citizen and enjoy visa-free travel to over 180 countries.